How to Trade ORB (Opening Range Breakout) on Nasdaq — A Complete Step-by-Step Guide with Examples

At Miami Trading Academy, we teach strategies that are simple, repeatable, and built around process, not guessing. One of the cleanest day-trading frameworks for Nasdaq is the Opening Range Breakout (ORB).

ORB is popular for a reason, the first part of the cash session often sets the tone for the rest of the day. If you learn to define the opening range properly, and only take the best breaks with a risk plan, you’ll stop chasing random candles and start trading a structured playbook.

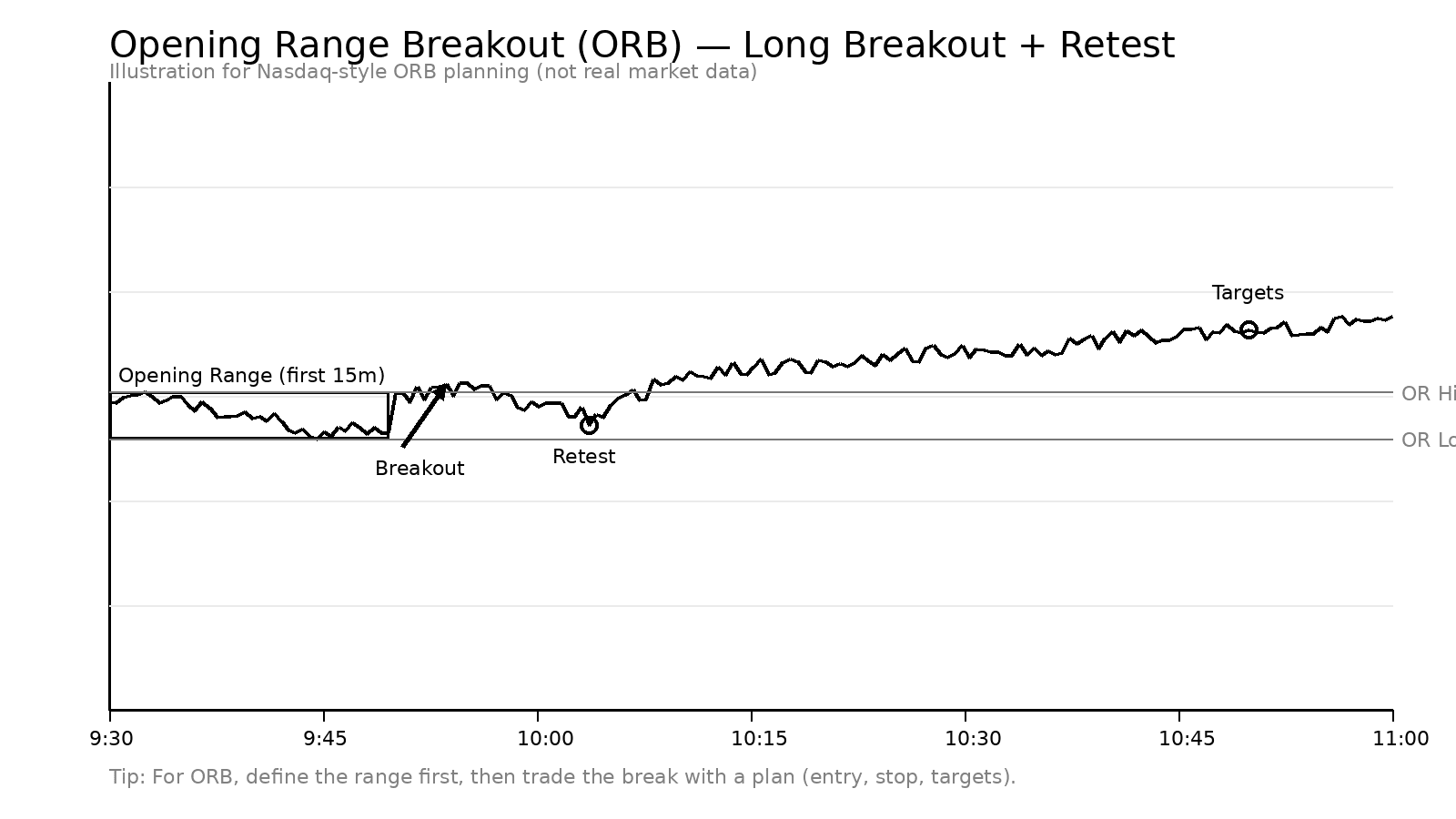

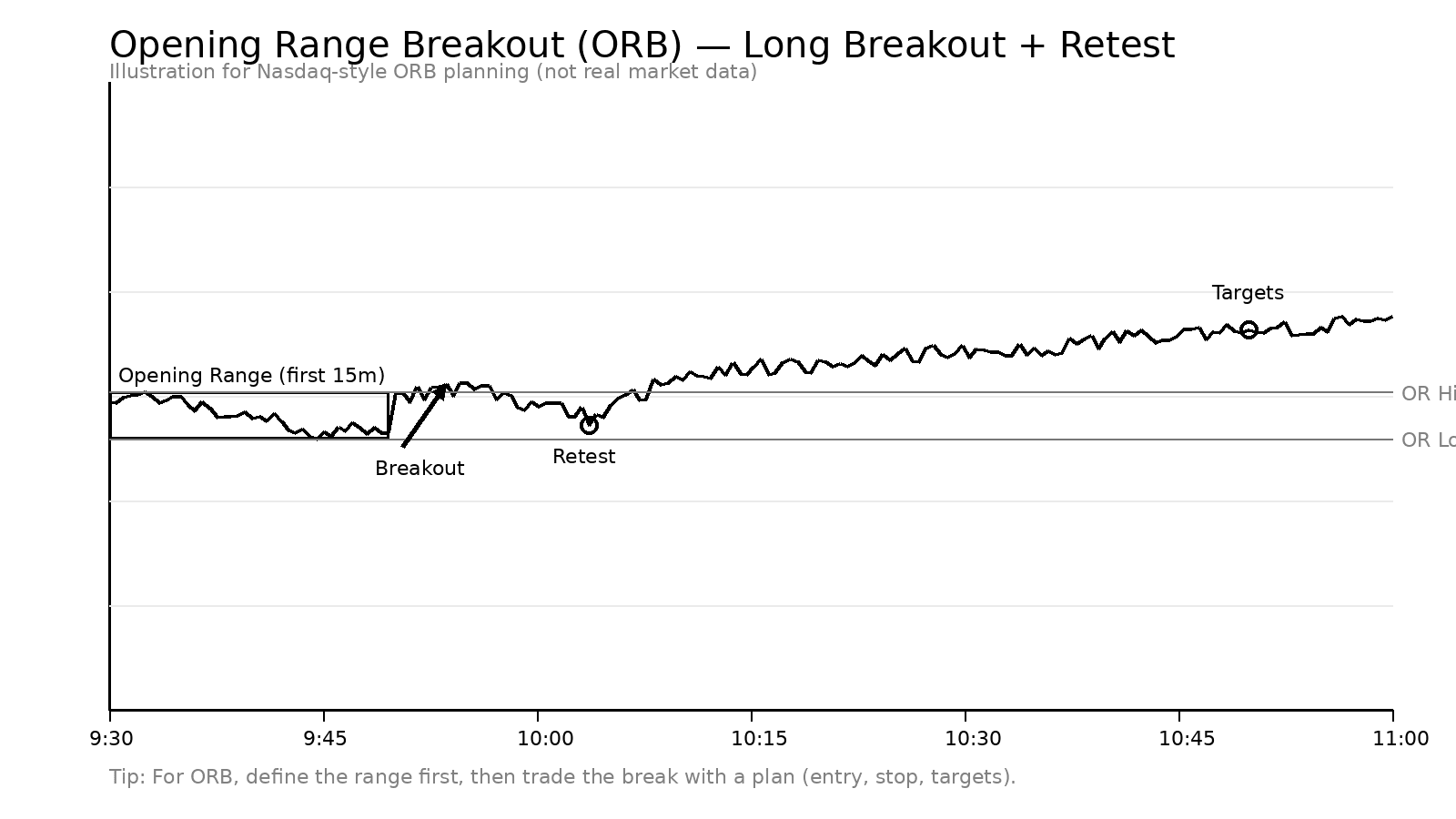

Diagram 1: Example of a clean ORB long breakout with a retest.

What ORB Means (In Plain English)

ORB = Opening Range Breakout. You define a “box” around the market’s early high and low, then you trade the breakout when price escapes that box with confirmation.

Think of the opening range like the market’s first “vote” on direction. When Nasdaq breaks out of that early range and holds, it often signals that institutions are pushing a real move. When it breaks and fails (a trap), that failure can be an equally powerful setup in the opposite direction.

What to Trade: Nasdaq (NQ / MNQ) vs QQQ

ORB works on multiple Nasdaq products, but most active day traders focus on:

- NQ / MNQ futures (Nasdaq-100 E-mini / Micro), faster movement, great intraday structure.

- QQQ (ETF), slower than futures, but still clean ORB behavior around the cash open.

This guide is written with Nasdaq futures behavior in mind, but the framework applies to QQQ too.

The Only ORB Windows You Need (Pick One)

The “opening range” is defined by a time window after the cash session opens (9:30am New York time). Most traders keep it simple and pick ONE window and master it.

| ORB Window | Best For | What It Looks Like |

|---|---|---|

| 5-Min ORB | Fast scalps, aggressive traders | Quick breakout attempts, more fakeouts |

| 15-Min ORB | Most traders (best balance) | Clean range, cleaner confirmation |

| 30-Min ORB | Trend days, bigger targets | Fewer trades, higher quality breaks |

If you want my honest recommendation: start with the 15-minute ORB, get consistent, then experiment.

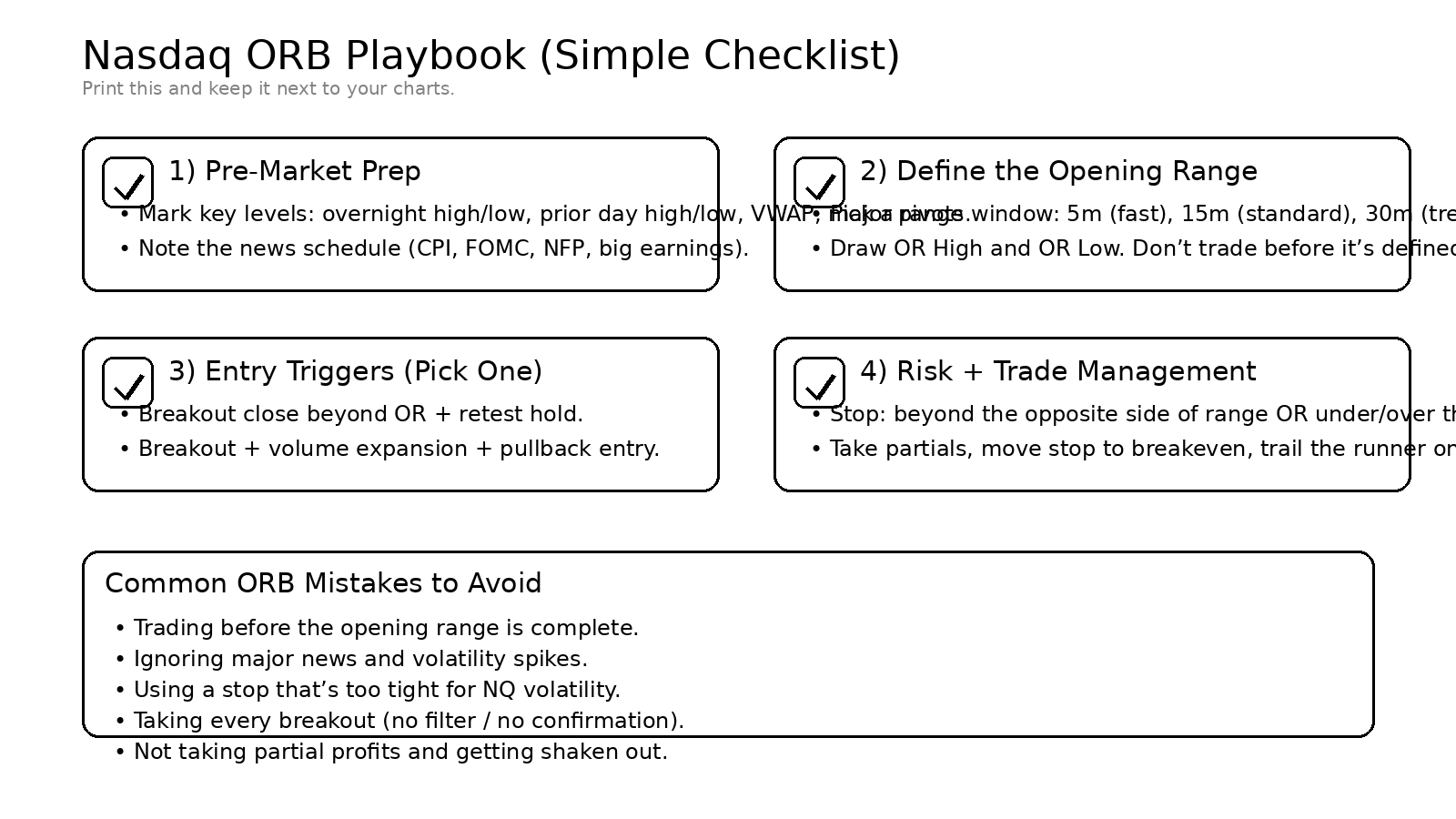

ORB Setup: The Simple 5-Step Playbook

- Mark key levels pre-market: overnight high/low, prior day high/low, and VWAP.

- Wait for the ORB window to complete (5m / 15m / 30m). No jumping early.

- Draw OR High and OR Low (your “box”).

- Only take a breakout with confirmation (close outside + hold/retest).

- Manage risk like a pro: predefined stop, partials, and a rule for when you’re wrong.

Diagram 4: Print-friendly ORB checklist you can keep next to your chart.

Entries That Actually Work (Avoid the Rookie Traps)

Here are the three entry styles that keep you disciplined. Pick ONE as your default:

- Entry Style A — Break + Close: candle closes beyond OR High (long) / OR Low (short). Enter on the next candle if it holds.

- Entry Style B — Break + Retest (best): breakout happens, price comes back to tap the OR level, holds, then you enter.

- Entry Style C — Stop Order + Filter: place a buy stop above OR High / sell stop below OR Low, but only if your filters agree (see below).

For Nasdaq, Break + Retest is usually the cleanest way to avoid getting wicked out on the first pop.

The Filters That Separate Pros From Gamblers

ORB is not “take every breakout.” Nasdaq will fake you out if you do that. Use 2–3 filters max (simple, not complicated).

- Trend filter: Is price above VWAP for longs (below VWAP for shorts)?

- Location filter: Is the breakout aligned with key pre-market levels (overnight high/low, prior day high/low)?

- Volume/impulse filter: Does the breakout candle expand and close strong (not a weak wick)?

- Time filter: Many traders only take ORB breaks in the first 60–90 minutes.

Risk Management (The Part That Makes ORB Profitable)

You can have the best entries in the world and still lose money if your stop and sizing are random. Here’s the clean ORB approach:

- Stop placement options:

- Conservative: stop beyond the opposite side of the opening range.

- Aggressive: stop beyond the retest swing (after break + retest entry).

- Position size rule: Decide your $ risk first, then size your contracts/shares based on stop distance.

- Profit plan: take partials at logical levels, then trail a runner if it trends.

Simple sizing formula:

Position Size = (Dollars you’re willing to risk) ÷ (Stop distance in points × value per point)

(Your platform shows the value per point for NQ/MNQ or your instrument — use that.)

Examples (So You Fully Understand ORB on Nasdaq)

Example 1 — Clean ORB Long: Break + Retest + Trend

Context: Pre-market is strong, price holds above VWAP after the open. The 15-minute range forms, then price breaks above OR High with a strong close.

- Entry: buy on retest of OR High after the breakout holds.

- Stop: below the retest swing low (or below OR Low if you want wider safety).

- Targets: first partial at 1R, second partial at next key level (overnight high / prior day high), runner trails.

- Invalidation: candle closes back inside the OR box and holds there.

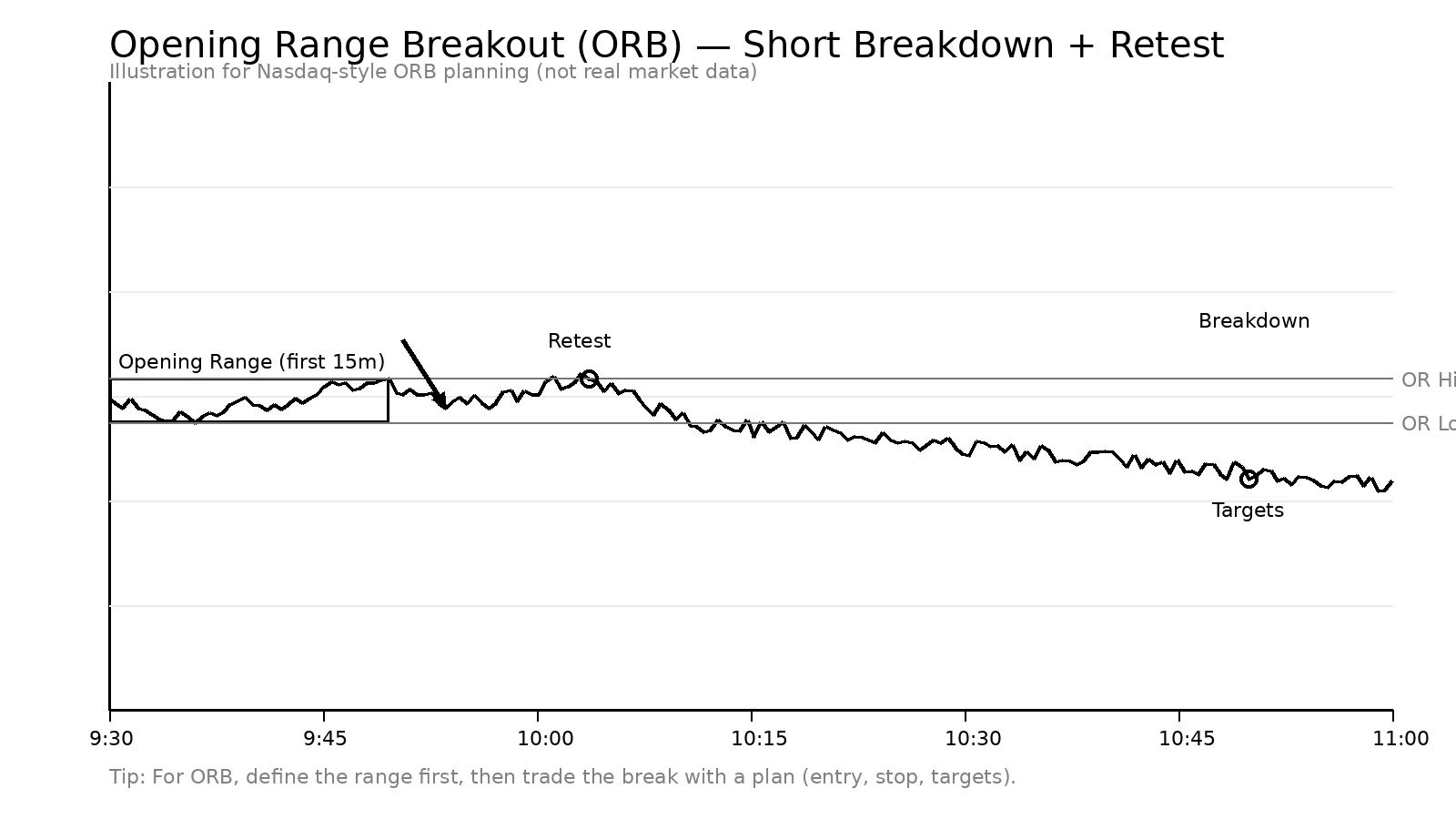

Example 2 — Clean ORB Short: Breakdown + Retest + Continuation

Context: Weak pre-market, price is below VWAP. The OR Low breaks, price retests it from underneath, then rolls over.

- Entry: sell on retest rejection of OR Low (now acting as resistance).

- Stop: above the retest swing high.

- Targets: partial at 1R, then aim for overnight low, then runner trails.

- Invalidation: reclaim OR Low and hold above it.

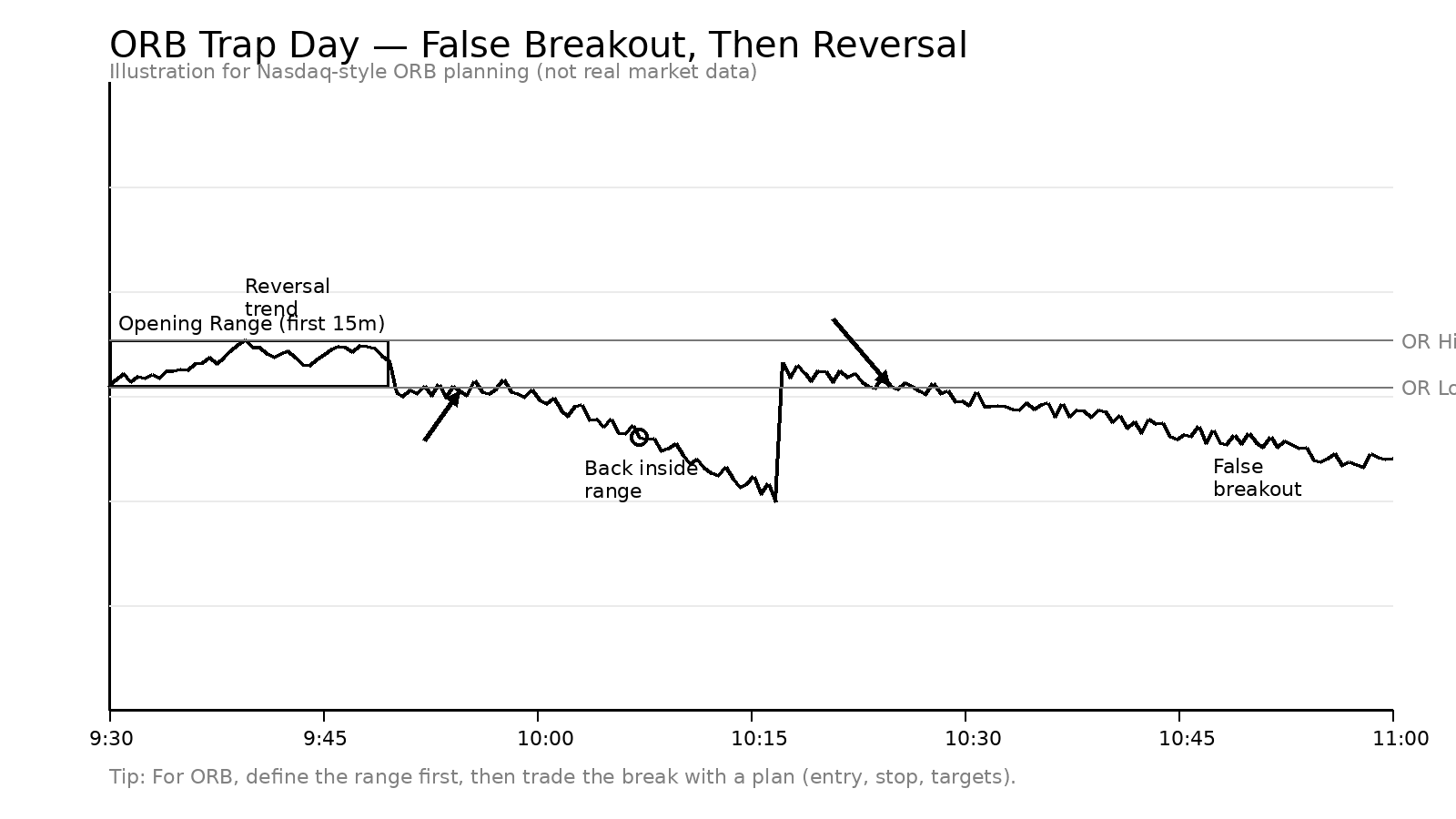

Example 3 — The Trap Day: False Breakout, Then Reversal

This is where most beginners get smoked. Nasdaq pops above OR High, everyone buys, then it fails hard back inside the range. That failure is information.

- Trap signal: break above OR High, then strong close back inside the range.

- Entry idea: short when price loses OR High again (or on retest of the failed breakout).

- Stop: above the false breakout high.

- Targets: OR midline first, OR Low second, then continuation if it becomes a trend down day.

Example 4 — Range Day: When NOT to Trade ORB Breakouts

Some days Nasdaq chops all morning. ORB will “break” and immediately snap back. Your job is to recognize this and protect your capital.

- ORB breaks happen with weak closes and long wicks.

- Price keeps returning to the OR midline.

- VWAP is flat and price is constantly crossing it.

- Best move: reduce size, take only A+ setups, or sit out.

Example 5 — News Spike ORB: How to Avoid Getting Destroyed

If major news hits right after the open, ORB can become chaos. The range can expand rapidly and your stop distance may double.

- Rule: if volatility is abnormal, either widen stops AND reduce size, or don’t trade.

- Wait for confirmation: don’t chase the first candle spike.

- Retest entry becomes even more important on these days.

Example 6 — ORB + Higher Timeframe Level (Best “A+” Combo)

One of the highest-quality ORB trades is when the breakout lines up with a bigger level (prior day high/low, overnight high/low, weekly pivot). When ORB breaks directly into “open air,” follow-through is often stronger.

- Entry: break + retest.

- Stop: beyond retest swing.

- Targets: next higher timeframe level, then trail.

Free 15-Minute Strategy Call — Let’s Build Your ORB Plan

Want help turning ORB into a repeatable rules-based system for your style? On our free 15-minute strategy call, we’ll help you:

- Choose the best ORB window for your schedule

- Build entry rules that fit your risk tolerance

- Set realistic targets and a clean trade management plan

Final Thoughts

ORB works when you treat it like a system: define the range, wait for confirmation, trade the best setups only, and manage risk like it matters (because it does). Nasdaq rewards discipline and punishes impulse.

Disclaimer

Trading involves substantial risk and is not suitable for everyone. Past performance is not indicative of future results. This content is for educational purposes only and does not constitute financial advice.